Future value of stock calculator

If you know your way around a graphing calculator you can work out an investments future value by hand using the equations above. Research and compare vehicles find local dealers calculate loan payments find your car.

Future Value Of Annuity Calculator

14H ago Snap laying off 20 of its staff in hopes of reducing costs.

. India Tel No- 022 - 2288 2460 022 - 2288 2470. Firstly calculate the value of the future series of equal payments which is denoted by P. To calculate the current value the ordinary annuity formula is used to determine the ordinary annuity calculator present value.

Future value of annuity calculator. Over the past 17 years Stock Advisors average stock pick has seen a 373 return more than 3x that of the SP 500. You can also sometimes estimate present value with The Rule of 72.

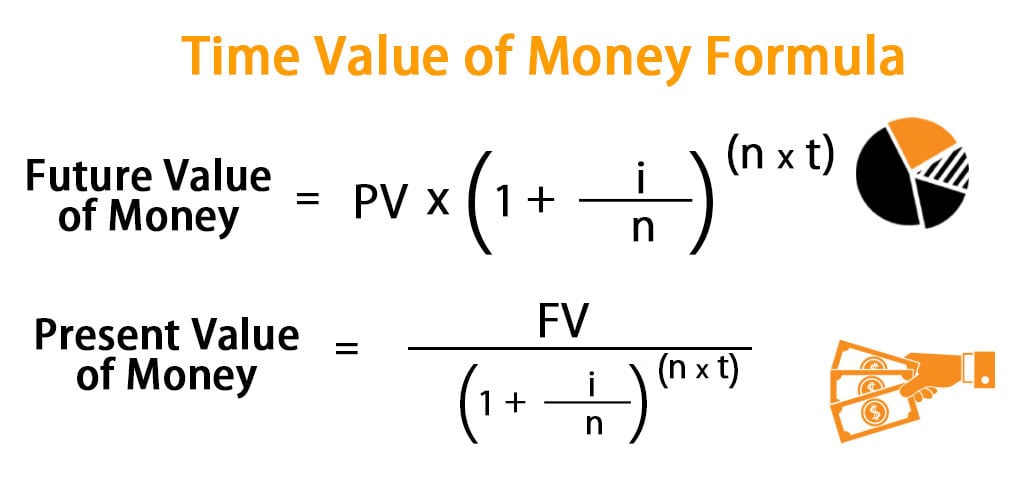

Investing in stock markets involves the risk of loss. For Aadhya the present value is INR 10000. FV PV 1 rn.

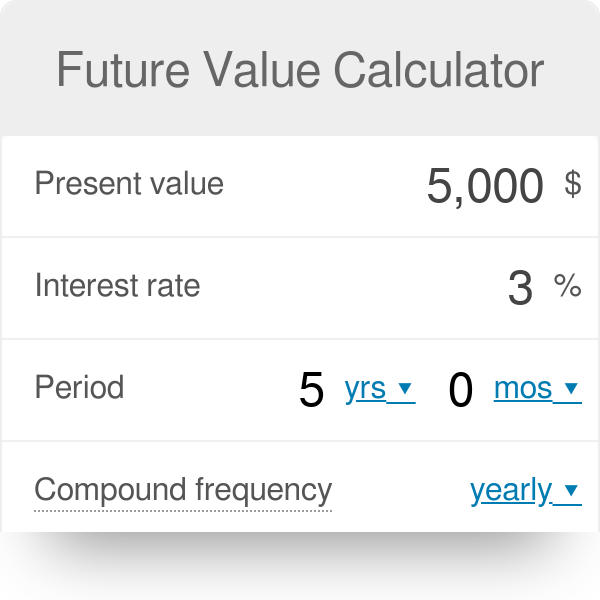

And pictures and video. For example if the rate of interest is at 5 and the rate of inflation is at 6 then the real rate of return is arrived at by deducting the rate of inflation from the rate of interest. The future value calculator is a simulation that determines an investments future value.

Net present value method is a tool for analyzing profitability of a particular project. The preferred stock valuation calculator exactly as you see it above is 100 free for you to use. There can be many ways to calculate the time value and this can be calculated by using the calculator we have provided below.

Future Value Calculator Input Definitions. R The rate of interest the investor will earn on the money. It sums the present value of the bonds future cash flows to provide price.

Future value FV is a measure of how much a series of regular payments will be worth at some point in the future given a specified interest rate. It takes into consideration the time value of money. Vega for this option might be 003.

The best intrinsic value calculator is Stock Rover which automatically calculates Fair Value Academic Fair Value Intrinsic Value. C p1i n - 1 Where is the nominal interest rate and n is the number of compounding periods. For example a 30-day option on stock ABC with a 40 strike price and the stock exactly at 40.

However several formulas can give you a rough estimate of the Intrinsic Formula. Allows for different compounding periods. Past performance is not an indication of future performance.

The calculator uses the present value formula to calculate compound interest. Example If an individual invests 1000 in the bank for 5 years at 10 interest the calculation would be as below. It returns a clean price and dirty price market price.

In other words the value of the option might go up 003 if implied volatility increases one point and the value of the option might go down 003 if implied volatility decreases one point. Future value calculator also does not take into account the real value of investments in the future. Real value of an asset is derived by accounting for inflation.

Where FV is the future value. Estimate the total future value of an initial investment of any kind. How to use the Stock intrinsic value calculator.

It calculates how much your money will be worth in the future. See How Finance Works for the present value formula. Formulas for Calculating Intrinsic Value.

Learn more and get started today with a special new. Shares of meme-stock company plunged 25 as it announced plans to line up 500M in new financing. N is the tenure of investment.

The current value of your. I-Sec is a Member of National Stock Exchange of India Ltd Member Code-07730 and BSE Ltd Member Code 103 and having SEBI registration. So for example if you plan to invest a certain.

A Dividend Discount Model Calculator which also estimates net present value like the DCF calculator but uses dividend history and growth instead. Present value is compound interest in reverse. PV The amount the investor has now or the present value.

Autoblog brings you car news. The formula for Future Value of an Annuity formula can be calculated by using the following steps. Where FV The amount the investor will have at the end or the future value.

Hence the PE Ratio can indicate a stocks future market performance. The cash flows in the future will be of lesser value than the cash flows of today. It can also be calculated by taking the difference between the intrinsic value and the premium of the option which means the sum of time value and intrinsic value would be the options premium.

Implies the number of time periods eg. You can use it to determine if the project is worth investing in. Months years etc the investment will grow or the frequency of compounding growth.

For instance on Excel if you go to the Formulas tab then the Financial tab you can click FV to. You can also use an online future values calculator or run the formula on spreadsheet software like Excel or Google Sheets. Future Value - FV.

The actual value of an ordinary annuity calculator which is a series of equal payments payable at the end of the following periods can be measured with the current value of the standard annuity calculator. Figuring Out the Future Value of an Annuity. If she invests this for 8 per annum for.

This page contains a bond pricing calculator which tells you what a bond should trade at based upon the par value of the bond and current yields available in the market sometimes known as a yield to price calculator. R is the expected rate of return per annum. The investment could be a deposit in a savings account a business project stock market.

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. Next calculate the effective rate of interest which is basically the expected market interest rate divided by the number of payments to be done during the year. An NPV calculator estimates the current value of an investment.

And hence the further the cash flows lesser will the value. The amount of deposits made during each time period. Implies the hypothetical growth rate for the investment.

Using the calculator you can calculate the value of an investment or project based on expenses revenue and capital costs. Future Value Factor FVF Calculator Perpetuity Yield PY Present Value of Perpetuity PVP and Perpetuity Payment PP Calculator Present Value PV and Future Value FV Number of Periods Calculator. N The duration for which the amount is invested.

A Discounted Cash Flow Calculator which uses estimated future earnings or cash flow growth to estimate the fair value of a stock or investment. Expert reviews of cars trucks crossovers and SUVs. Among other places its used in the theory of stock valuation.

Finding the amount you would need to invest today in order to have a specified balance in the future. Future value is the value of an investment at a future date at an expected rate of return. Advantages of Net present value method Time value of money.

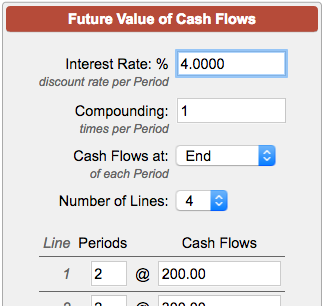

Future value calculator with cash flow periodic additions or withdrawals inflows or outflows. PV is the present value. FV PV 1rn.

The future value FV is the value of a current asset at a specified date in the future based on an assumed rate of growth over time.

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

Present Value Of Stock With Constant Growth Formula With Calculator

Fv Function In Excel To Calculate Future Value

Time Value Of Money Formula Calculator Excel Template

Present Value Formula Calculator Examples With Excel Template

Future Value Calculator Wolfram Alpha

Future Value Calculator With Fv Formula

Present Value Pv Formula And Calculator Excel Template

Future Value Fv Formula And Calculator Excel Template

Future Value Of An Annuity Formula Example And Excel Template

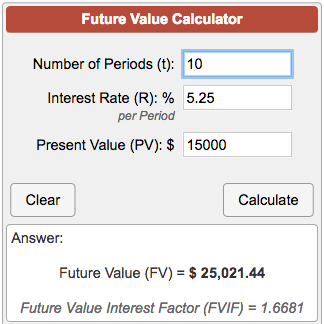

Present Value Calculator

Future Value Fv Formula And Calculator Excel Template

Future Value Of Cash Flows Calculator

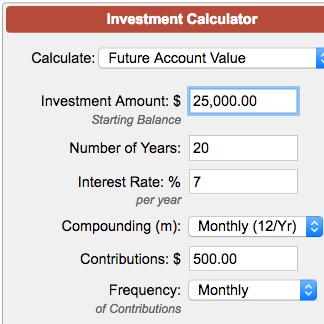

Investment Calculator

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

Future Value Calculator Basic

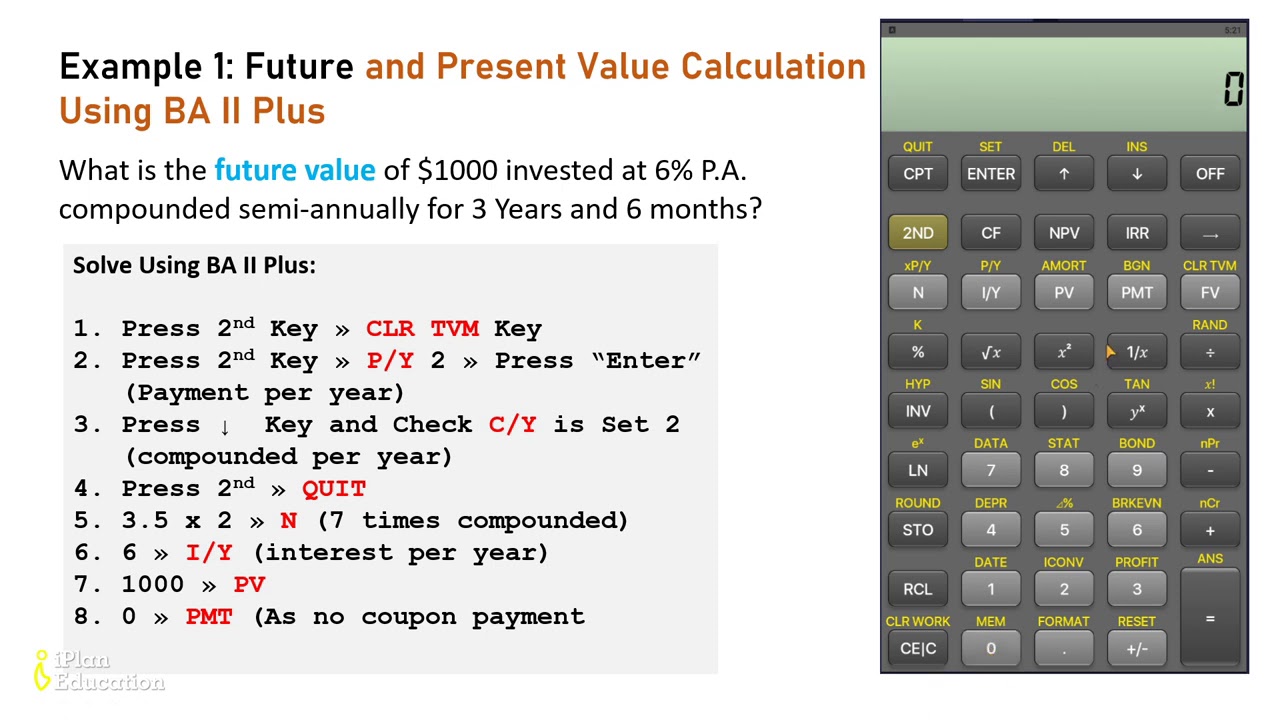

Ba Ii Plus Calculator Tutorial Future Value And Present Value Calculation Youtube