57+ how to calculate self-employed income for mortgage loans

Ad This program has funded more than 28 billion worth of loans in the past fiscal year alone. Ways that Lenders Calculate Income.

Pdf The Demise Of The Participation Society Welfare State Reform In The Netherlands 2015 2020

Web A borrowers income is calculated by adding it up and dividing to total by 24.

. A great credit score Credit score is a major factor in landing a mortgage. Generally the average of two years is used as the basis for determining. Web Divide the sum by 24 to find your average monthly income.

Web 3 hours ago30-Year Fixed-Rate Mortgage Refinance Rates. For a Fannie Mae conforming mortgage for example you can qualify with 12 months of self. Web How To Calculate Self-Employed Income.

Web To get a self-employed home loan apply after earning at least two years of steady income while working for yourself. The average rate for the 30-year fixed-rate mortgage refinance rose to 718 from yesterday. When a lender reviews business income they look at not just the most recent year but a two-year period.

Debt Consolidation Loans up to 50000¹. For example say year one the. Web You will need to demonstrate that youve been self-employed in the same line of business for the last two years before that income can be considered for your.

Research Fund Options That Fits Your Investment Strategy. Web In some cases you only need 12 months of self-employment. Web How to Calculate Self-Employed Income for a Mortgage Business owners that receive a regular paycheck and W2 have an easier time with documentation.

Ad Learn More About Mortgage Preapproval. Get Started In Your Future. Web how should my maximum loan amount be determined up to 10 million.

Estimate your monthly mortgage payment. Web For a self-employed person the tax returns will be used to determine the qualifying loan amount. Web Our self-employed mortgage calculator will show you how much you could borrow on a mortgage.

Check Your Official Eligibility Today. Find out the miscellaneous information about 7a loans most bankers dont even know. Web When considering a mortgage application from a self-employed borrower the bank will not only evaluate your financial health but the state of the business likely.

Web Consider the following to increase your chance of being approved for a mortgage while self-employed. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Take Advantage And Lock In A Great Rate.

Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans. Calculating income for a self-employed borrower ranges from simple to complex.

They calculate your income by adding it up and dividing by 24 months. Browse Information at NerdWallet. 75000 Average yearly income.

Web Two-year self-employed average income. Use NerdWallet Reviews To Research Lenders. Realize Your Dream of Home Ownership this Year.

Your revenues for year one for example is within the 80000 while it increased the. For example lets say you earned a net profit of 60000 in 2020 and 75000 in 2021. Ad See how much house you can afford.

Web Because self-employed income can vary from month to month lenders need a way to calculate a predictable number. Web Higher Debt-To-Income Ratio. Ad Insured by NCUARates Quoted Assume Excellent Borrower Credit History.

And in some cases theres a liquidity test that. Ad We Are a Locally-Owned Mortgage Broker. Web Heres how a lender would calculate your monthly income for qualifying purposes.

Last week the 30. Speak to one of our Mortgages experts to get a more detailed idea of what. Raise your credit score and put down the.

Ad Take the First Step Towards Your Dream Home See If You Qualify. Web Our self employed income calculator can give you a general idea of what your income looks like once you add back and deduct certain things. Updated FHA Loan Requirements for 2023.

This makes FHA loans easier to qualify for than Conventional loans where the DTI can only be up to. FHA loans can have a DTI of as much as 57. Self-employed farmers and ranchers ie those who report their net farm profit.

How Do Banks Calculate Self Employed Income For A Mortgage Youtube

Pdf Validating Share In France With Other French Surveys Health And Income Data Anne Laferrere Academia Edu

Self Employed Mortgage Loan Requirements 2023

Dsa Mastery Training Ebook Paisapaid Com

15684 Jug Road Burton Oh 44021 Mls 4365805 Howard Hanna

New Mortgage Requirements For Self Employed Borrowers

How Much Mortgage Can You Afford If You Re Self Employed Embrace Home Loans

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

How To Get A Mortgage When You Re Self Employed Rocket Mortgage

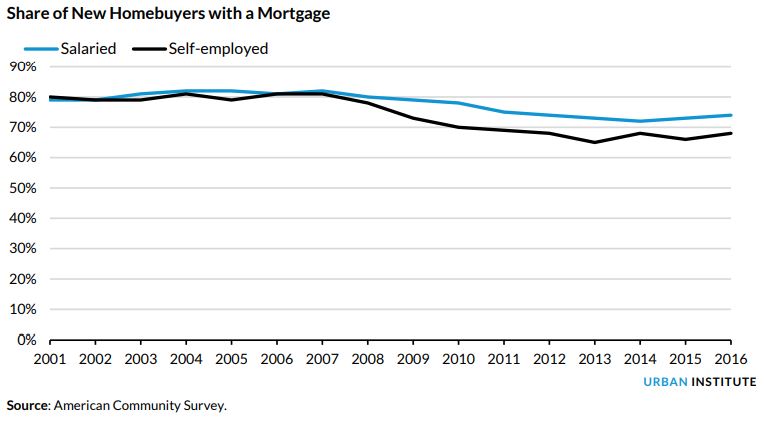

The Mortgage Market Is Not Meeting The Needs Of Self Employed Workers Urban Institute

How Much Mortgage Can You Afford If You Re Self Employed Embrace Home Loans

Self Employed Mortgage Loan Requirements 2023

How Is Self Employment Income Calculated For A Mortgage Banks Com

2023 Mortgage Guide For Self Employed Borrowers

Calculating Income For Mortgages With Schedule C Or C Ez Youtube

Understand How Lenders Calculate Self Employment Income Before You Apply For A Mortgage The Zen Team

Mortgage Broker Gippsland Sale Traralgon Surrounds Mortgage Choice